Shaoxing Shangyu Area State-owned Capital Investment Management Co., Ltd. (hereinafter referred to as “Shangyu State-owned Company”) successfully issued fixed-price overseas bonds of $300 million with maturity for 3-year ( with interest rate of 2.95%) and $200 million with maturity for 5-year (with interest rate of 3.55%) on March 9, 2021. The $200 million bond issued this time is the only 5-year US dollar bond of the same type in China in the past three years. And the $300 million bond has created the lowest issuance interest rate for the 3-year bonds of the same type in China in the past three years.

The issuer, Shangyu State-owned Company is the largest state-owned capital operation and management entity in Shangyu District, Shaoxing City. It is the only over-large state-owned investment enterprise specializing in state-owned capital investment and operation in Shangyu District. Its main business includes water supply, service, logistics, commodity sales, land development, engineering construction, housing sales, etc. Since its establishment, Shangyu Stated-owned Company has received strong support from the local government in policy, capital, assets, project resources and many other aspects.

The legal team consist of the senior partners of Long An Shanghai, Ying PENG, Wei QIAN and the partner Xing SHAO etc. acted as the Chinese legal counsel of the underwriter and provided full legal services for the overseas bond issuance project.

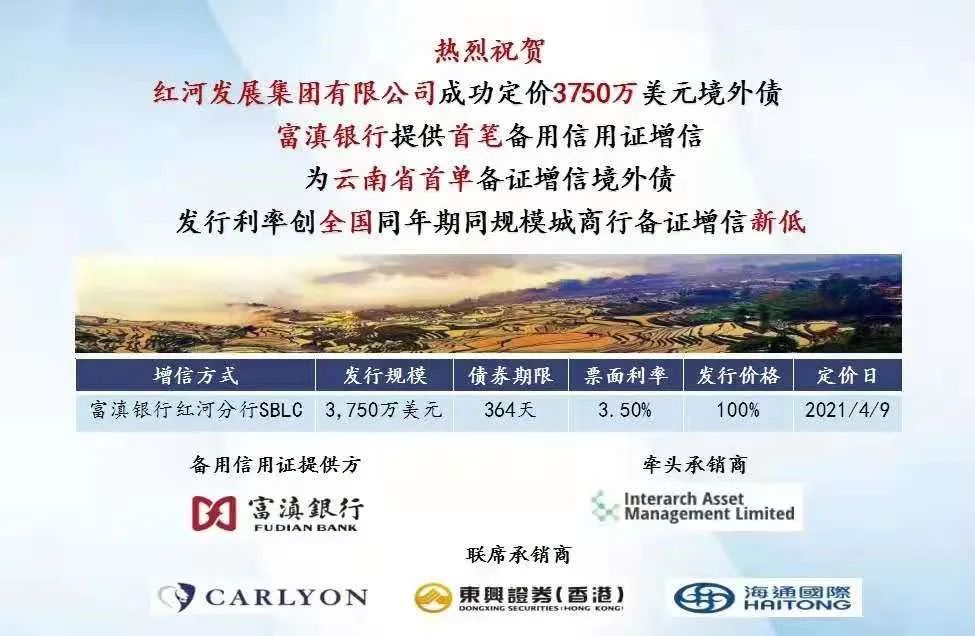

Honghe Development Group Co., Ltd. (hereinafter referred to as “Honghe Development Group”) successfully issued fixed-price overseas bonds of $37.5 million with maturity for 364 days and an interest rate of 3.50% on April 9, 2021. Fu Dian Bank provided the first standby letter of credit for the bond, which was the first overseas bond with standby letter of credit in Yunnan Province. The issuance interest rate hits a new low for the same scale city commercial back standby letter of credit at the same year in China.

The issuer, Honghe Development Group, is a large-scale state-owned enterprise under the direct leadership of the People’s Government of Honghe Prefecture. It is the most important entity of infrastructure construction and urban operation in Honghe Prefecture. Honghe Development Group undertakes the infrastructure and shantytown reconstruction work of the Honghe Prefecture. At the same time, Honghe Development Group also undertakes the investment, financing and construction of water conservancy and hydropower projects, poverty alleviation projects and other works. It has become an important bearer of poverty alleviation and economic development of the Honghe Prefecture.

Entrusted by Honghe Development Group, the legal team composed of the senior partners of Long An Shanghai, Wei QIAN and Ying PENG, the lawyer Zhenyan MA, and the legal assistant Shanshan CHANG etc. acted as the Chinese legal counsel of the issuer and provided full legal services for this overseas bond issuance project. This overseas bond project is the second time that Long An team be entrusted by Honghe Development Group as the China legal counsel of the issuer. Long An Law Firm has won the recognition and trust of clients through professional legal services.

原文始发于微信公众号(隆安律师事务所):隆安业绩|隆安律所接连助力上虞国资公司、红河发展集团成功定价发行境外美元债

LONGAN LAW FIRM

LONGAN LAW FIRM